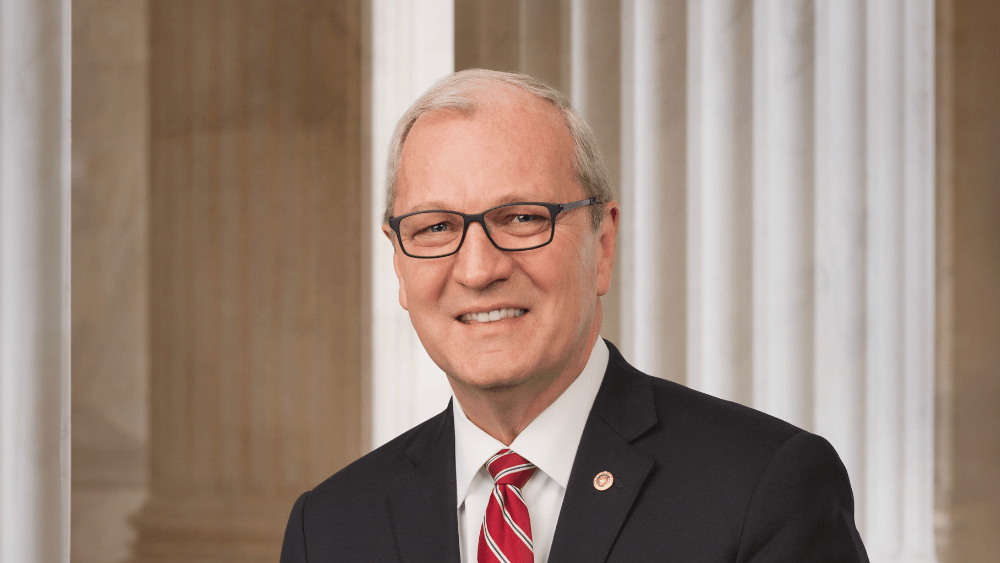

Conversation with Governor Kelly Armstrong and Scott Hennen

BISMARCK, N.D. – North Dakota Governor Kelly Armstrong responds to people upset agriculture land wasn’t part of his plans for property tax relief and reform.

“If they figure out more property tax relief to give to North Dakota citizens throughout the course of this session, I would be comfortable signing that as well. I don’t think you can shoehorn it into how we did the primary residential credit. Farmland is owned in LLPs, LLCs. It just gets into a different realm of where you would do property tax relief,” Armstrong explained.

Armstrong’s plan would give $1,440 in relief to homeowners in the form of a primary residency credit. It would also cap local government subdivisions’ spending at an increase of three percent. The legislation was given a pass recommendation by the House Finance and Taxation Committee and is set to be heard in the Appropriations Committee.

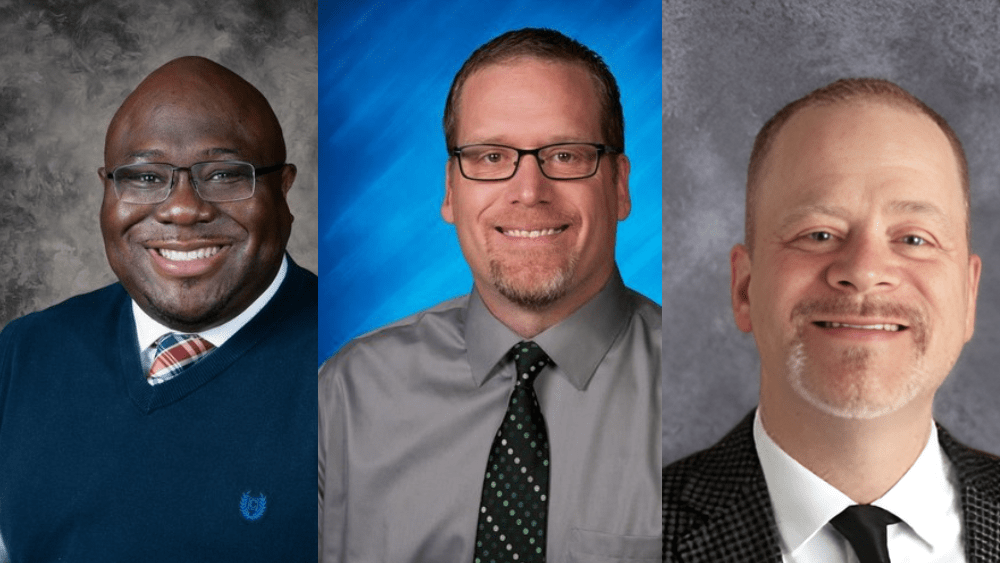

A bill in the Senate introduced by Republican State Senators Robert Eberle of Lehr, Jerry Klein of Fessenden and Janne Myrdal of Edinburg would buy down 30 mills for school districts funded by ag land property taxes.

“I think it brings more equity to a larger base of citizens if we include ag land along with the residential folks,” Eberle explained.

The bill was given a pass recommendation by the Senate Finance and Taxation Committee and is set to be heard in the Appropriations Committee.