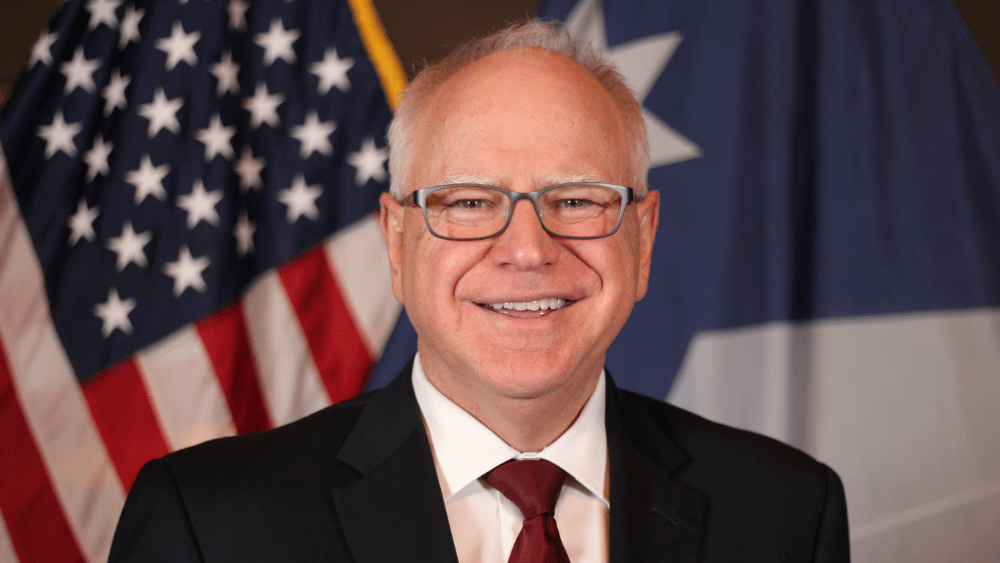

[ST. PAUL, MN] – Governor Tim Walz announced Friday that new figures released by the Minnesota Department of Revenue show the state’s nation-leading Child Tax Credit has put over $545 million into the budgets of more than 215,000 Minnesota families this year.

With the majority of 2023 individual income tax returns processed, the department reports that more than 215,000 tax returns claimed the new Child Tax Credit, claiming over 437,000 eligible children for an average total credit of $1,244 per child.

“This year, we invested directly in the financial security and wellbeing of families across the state through our nation-leading Child Tax Credit,” said Governor Walz. “I’m grateful that nearly 440,000 children have already benefited. Minnesota is setting an example for the nation of how to lift families up, cut child poverty, and build a brighter future for Minnesotans.”

“This historic tax credit is a game-changer for Minnesota families,” said Lieutenant Governor Flanagan. “I’m beyond thrilled to know that hundreds of thousands of families can live with a little less stress knowing there is extra money in the bank this year. This credit will help Minnesotans afford groceries, rent, or a new backpack for school, and this is just one way we are making Minnesota the best state for children and families.”

“Through the leadership of Governor Walz, Minnesota’s Child Tax Credit has become an effective tool in our goal of reducing childhood poverty and making Minnesota the best place to raise a family,” said Revenue Commissioner Paul Marquart. “The advanced payment option he championed will make the credit even more effective – allowing parents to budget and utilize the money throughout the year.”