A movement to dramatically change how local government is funded, in North Dakota, has cleared a key hurdle on its path to the November ballot.

The group, End Unfair Property Taxes, has turned in more than 40,000 signatures for a petition that would end assessment-based property taxes. The Secretary of State’s office is currently reviewing the signatures to determine their validity. The group needs 31,164 valid signatures to proceed to the statewide general election ballot.

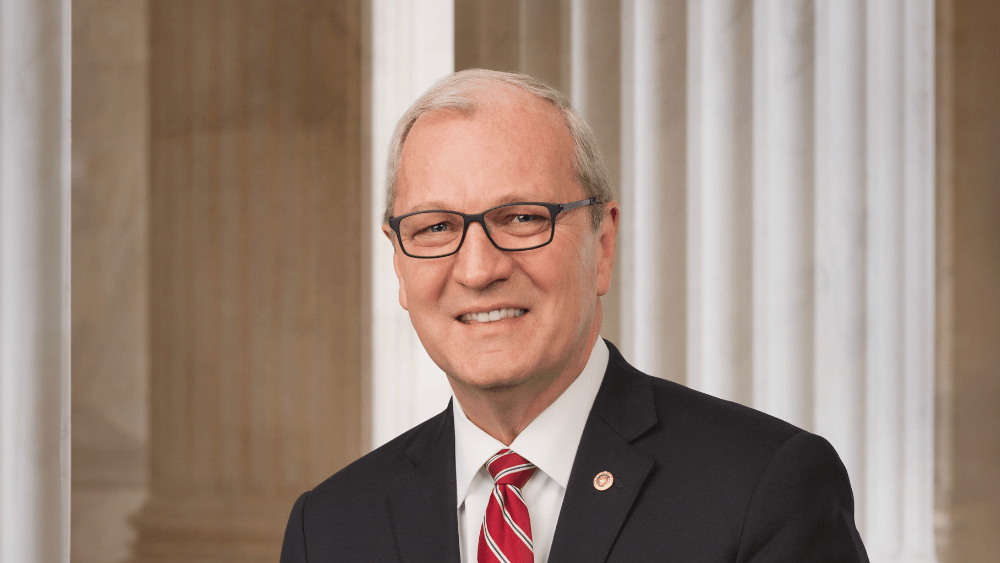

The face of End Unfair Property Taxes is Rick Becker, former State Representative who ran unsuccessfully for Congress in the June primary.

According to the group’s website, the way the plan would work is that the current amount of property taxes paid, for all types of property, would be recorded. That amount of funding would then be paid to local government entities from existing state revenue, each year, instead of being paid by the property owners. If that entity needs additional money in the future, which is all but certain, it would need to create a new tax or fee that is not based on property value.

The change would effectively ensure that property taxes based on assessed valuations will no longer be allowed.

Estimates of the new cost to state government would be between $1.1 and $1.3 billion annually.

Opponents say it is unclear where the legislature would find the necessary funds, while backers say the state has the money to make the change if spending cuts are enacted.

Becker appeared last week on KTGO Radio’s “What’s On Your Mind” program, along with Rich Wardner, former North Dakota Senate Majority leader, and critic of the proposal.

“We have an opportunity to do two things in one fell swoop with this measure,” said Becker. “One is to provide significant property tax relief so that everything that people are paying right now in property tax, they will get to put in their pocket year after year. We do that in a way where we retain 100% local control because the Constitution, when this passes, would require the state to replace that, no questions asked no strings attached. And then the second part is reforming, because the locals will continue to have full control to raise the revenue they need for their increasing budgets, this just makes it so they cannot do evaluation-based property tax because people hate how it’s done. It’s not transparent, it doesn’t seem fair, there’s very little recourse, and people don’t understand it. That’s not the right way to tax people. So, it does both of these things, it’s really a great opportunity for North Dakota.”

Wardner one of his major concerns is that non-residents will also benefit.

“I think we have a real concern here. 38% of the property taxes in the state are paid by commercial property, and centrally assessed, and of that, about 32% of those are out of state. We also have about 15 to 20% of the residential and ag land property taxes are paid by people from out of state. So, we’re around 50% on the property taxes that are paid in North Dakota are going to benefit those people that live out of state, and some of those people are Bill Gates, who we already know has his nose in the state, we’ve got Warren Buffett, and we’ve got Canadians, and I will tell you that Bill Gates and Ted Turner do not have any of our values, and I don’t see why we would want to give any benefit to them.”

Becker says there is not a way to constitutionally exclude out-of-state landowners and that it would be a mistake to look past the benefits to many, rather than the impact to a few.

“If you look at what the state and cities are doing to try and incentivize Walmart and incentivize Amazon, and they’re giving them 5, 10, 15, years of no property taxes. So, they are getting property tax breaks, but the average North Dakotan doesn’t? It’s shocking to me that we would say ‘You know what, this would be great for me, this would be great for my family, great for my kids but I don’t want Walmart to get a break so screw it we’re just going to keep spending like crazy.’ It comes along with it and it’s the price we pay. If we want to get property tax relief, we have to give property tax relief, and there’s a small percentage of people who own property that are out of state. Why would we focus on that? Why don’t we focus on the fact that you no longer have to pay what you’re currently paying in property taxes and what you can do for your family.”

Another key issue is how the state could afford the increased financial burden.

Proponents say that the state could free up as much as $2.5 billion annually by curbing what they feel is unnecessary spending and say that the state has increased spending dramatically faster than neighboring South Dakota.

Wardner vehemently denies that the state has spent recklessly and that some of the legislature’s recent additional expenditures are for expenses that would have resulted in higher taxes if not for government involvement.

“I’m willing to go head-to-head anyplace on the budget,” says Wardner. “We’ve heard this argument before about South Dakota. They are correct when they say that 2.5 billion per year is spent more in North Dakota than South Dakota, but it’s a deception thing. They don’t tell you where that money goes. I’ll tell you where that money goes. North Dakota, because of oil, sends money back to the political subdivisions. $5.5 billion every two years goes back to political subdivisions and South Dakota is unable to do that. And in that, is $1.8 billion dollars of property tax and it is reform that came back to the people that they don’t have to pay. You have to spend money to run schools and County social services. So that money, instead of being on the backs of the local property taxpayers, went back to the state.”

Becker says the state has two opportunities; to tap into the state’s growing financial assets, and to curb special-interest spending.

“The legislature is going to have a billion dollars of excess revenue at the end of this biennium, because The Common Schools Trust Fund, the earnings on that, is $500 million and the Legacy Fund earnings are $500 million. We’ve got one-time spending projects they went berserk this last session; well over $500 million. There’s $750 million per year spent on pork, corporate welfare, and special interests. I mean, we’re talking the Teddy Roosevelt Library, $125 million for a fertilizer plant, $20 million for Buffalo World, $26 million for a private drone company, $600,000 for a guy to make a film about Governor Burgum’s grandma. There is so much money that these guys are giving away to special interests. Stop doing that and that pays for it all, and we haven’t even talked about the money that will come to the state because of how this is going to drive the economy, bring young families to North Dakota because of this opportunity, and incentivize businesses to come to North Dakota to create economic diversification because we’ll be the only state with no property tax. That’s going to drive additional income tax revenue and sales tax revenue to the state.”

Wardner says claims of state expenditures are either inaccurate or misrepresented in the cases of Buffalo World and the Teddy Roosevelt Presidential Library, and when it comes to rising expenses, inflation plays a large role.

“Everything costs more, and we have to compete at the local level for employees out here in the West. If the county and the city don’t pay up, they’re gone to the oil fields. That’s what’s driving all this, and I’ll tell you that as far as the different ways of funding local government, and especially schools, we will be in court because it says in the Constitution that you have to have equalization of funding behind every child and if they do it different ways, that isn’t going to happen.”

Opponents also raise concerns about what happens if the state’s oil industry suffers a slowdown. Proponents say that a review of the last 10 years shows the state would have been able to meet its obligations during the oil price crashes of 2015 and 2020 if this measure had been in place.

Recently, a coalition called Keep it Local announced that it opposes the measure because it would threaten funding of local government services, including schools, first responders, and programs for low-income residents.

The Secretary of State’s office says it expects to rule on the validity of the petition signatures by early August.

Becker says he has concerns about the signature-verification process.

“You never say never until it’s done. It always concerns me when there’s a measure that the general consensus of elected officials is they’re not in favor of it. I don’t know if they scrutinize a little more closely or not. But I would hope that we have enough of a margin that the people of North Dakota will get to decide.”