(BISMARCK, ND) – A Montpelier, N.D., Republican is reflecting on Governor Kelly Armstrong’s property tax legislation he announced in the State of the State address.

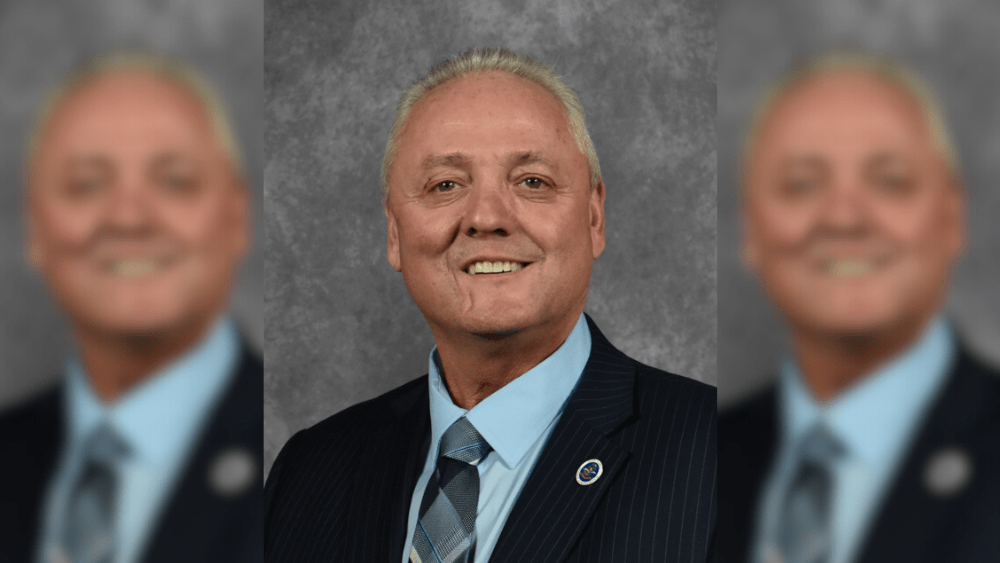

“I’m appreciative of having this collaboration with the Governor,” Representative Craig Headland (R-Montpelier) said. “We’ve talked to him about this idea. I think it’s a great start.”

Armstrong outlined a property tax relief and reform plan that would put the majority of primary residences on a path to zero property taxes within the next decade. The tax relief portion of the plan is twofold — it will increase the existing Primary Residence Credit from $500 to $1,000 per year at a cost to the state’s general fund of about $310 million for the 2025-27 biennium, and it will use a dedicated stream of Legacy Fund earnings – $173 million next biennium – to provide additional funds to the primary residence credit, initially $550 per residence. The total combined primary residence relief will be $1,550 per year in the 2025-27 biennium and at least $2,000 dollars per year in the 2027-29 biennium.

Headland said the legislation will go through the process. He says he questions the sustainability.

Legislators will try to get ‘the best package we can.’

“Something that we believe is sustainable,” Headland said. “And that suits the public to the best of our abilities.”

He said caps are a huge piece of the legislation.

“Whether three percent is that number, something more or less, and the bankability of it,” Headland said. “That’s all up to the process and debate.”